inherited annuity taxation irs

How qualified annuities are taxed. SPIAs are also beneficial for younger people who have inherited a large sum of money and wish.

Annuity Exclusion Ratio What It Is And How It Works

Retirement funds that are in effect for at least one year to the extent those funds are in an account that is exempt from taxation.

. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death. The term is intended to honor Vanguard founder and investor advocate John Bogle. If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021.

Understanding The Facts PLR 201330016. For variable annuity contracts issued prior to 102179 there is a step-up in basis for income tax purposes and no income tax is payable on the earnings. Also referred to as Federal Employer Identification Number or FEIN See IRS website for more information.

Longevity annuities have been around for years. More than 130 countries representing more than 90 of global GDP have agreed to cooperate on a two-pillar plan to reform the taxation of multinational companies. Modified AGI limit for certain married individuals increased.

In July 2014 the IRS approved the purchase of QLACs with pre-tax or so-called qualified account money. Taxation on qualified annuities is straightforward. The annuity that makes up a QLAC isnt a new idea.

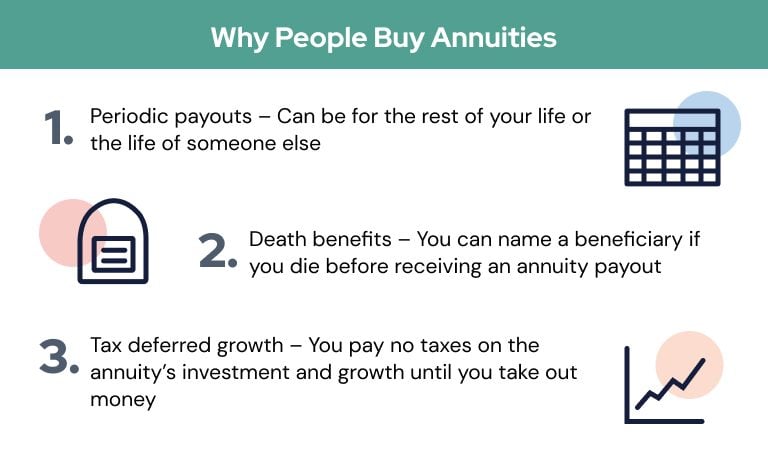

The Bogleheads emphasize starting early living below ones means regular saving broad diversification simplicity and sticking to ones investment plan regardless of market conditions. How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or someone else. An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death.

If the owner had already begun receiving required minimum distributions RMDs at. An individual retirement account that is left to a beneficiary after the owners death. If the annuity owner receives a lump sum distribution at a value below their cost basis they may be able to claim the loss on their federal tax return if they.

Employer Withholdings New Jersey employers payors of gambling winnings payors of pension and annuity income and. The earnings on an inherited annuity are taxable. This implies that you would be paying for an annuity with post-tax dollars which the IRS classifies as a non-qualified annuity.

Under Private Letter Ruling 201330016 taxpayers mother owned a series of non-qualified fixed and variable annuities for which the taxpayer was the beneficiary of the contractsWhen the mother passed away the beneficiary made a timely election to stretch payments over her life expectancy and began distributions. Since funds in those accounts dont count as retirement savings youll have to pay taxes on them every year. A nine-digit number assigned by the Internal Revenue Service IRS and is used to identify a business entity.

If your annuity was purchased with money that youve already paid taxes on then only your earnings will be taxed when the money is withdrawn. Taxation One of the most attractive features of annuities is their favorable tax treatment from the IRS. However in the Bobrow case the Tax Court reviewed the strategy after Bobrow made a mistake in executing it raising the attention of the IRS in the first place and declared that the IRA aggregation rule under IRC Section 408d3 should apply for the purposes of the once-per-year rollover rule not just in the context of calculating the pro-rata tax consequences of an.

Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915 for that years. Bogleheads is the title adopted by many of the investing enthusiasts who participate in this site. The first pillar would impact how a company allocates its profits to jurisdictions while the second pillar would seek to set a minimum level of tax that must be imposed on business.

Schedule K-1 is an IRS tax form that reports a beneficiarys income credits and deductions from a trust or estate. But the way the IRS now treats a longevity annuity within a tax-deferred retirement account such as an IRA or 401k has changed. From there you can see if your employer will calculate your tax withholding at the 22 percent flat rate the IRS allows for supplemental wages.

Form 8915-F replaces Form 8915-E. This is under section 401 403 408 408A 414 457 or 501a of the Internal Revenue Code of 1986. For trusts distributions are taxable to.

Inherited Annuity Tax Guide For Beneficiaries

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

How Much Taxes Should I Plan On Paying For My Annuity Due

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Various Annuities Are Taxed

Inherited Annuities What Are My Options 2022